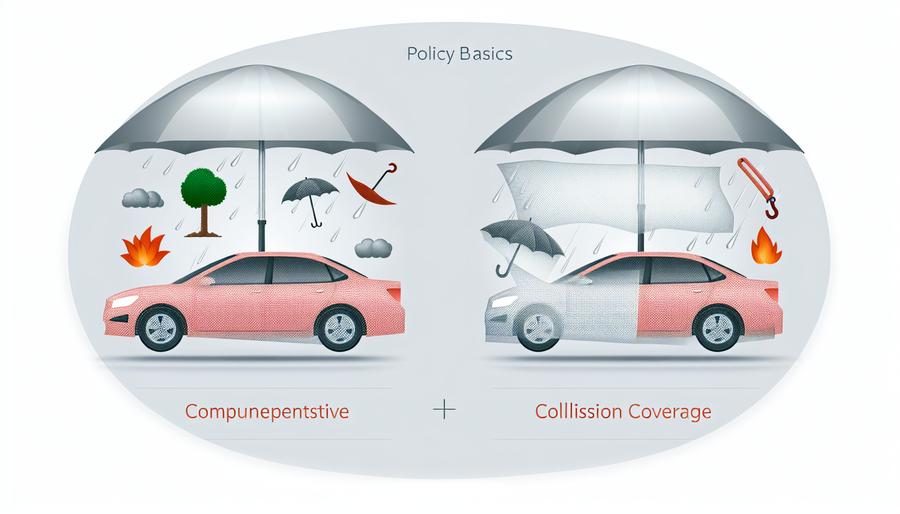

Understanding Comprehensive and Collision Coverage in Car Insurance

Car insurance can be confusing, especially when it comes to understanding different types of coverage. Two key components of an auto insurance policy are comprehensive and collision coverage. These coverages protect your vehicle in different ways and are often required if you have a car loan or lease. In this article, we'll break down what each coverage entails, how they differ, and whether you need them.

What is Comprehensive Coverage?

Comprehensive coverage helps pay for damage to your car that isn’t caused by a collision. It typically covers:

- Theft – If your car is stolen, comprehensive coverage can help replace it.

- Weather-related damage – This includes hail, floods, hurricanes, and more.

- Vandalism – If someone damages your car intentionally, such as keying it or breaking a window.

- Animal collisions – Hitting a deer or another animal falls under comprehensive coverage.

- Falling objects – Damage caused by things like tree branches or debris.

This type of coverage ensures that unexpected events outside of an accident don’t leave you with costly repairs.

What is Collision Coverage?

Collision coverage, on the other hand, covers damage to your vehicle resulting from a crash, regardless of who is at fault. It typically includes:

- Collisions with another vehicle – If you hit another car or someone hits you.

- Single-car accidents – Such as hitting a fence, pole, or guardrail.

- Rollovers – If your car overturns due to an accident.

Collision coverage is particularly important for protecting your investment in case of an accident.

Key Differences Between Comprehensive and Collision Coverage

| Feature | Comprehensive Coverage | Collision Coverage |

|---|---|---|

| Covers theft? | ✅ Yes | ❌ No |

| Covers weather damage? | ✅ Yes | ❌ No |

| Covers hitting an animal? | ✅ Yes | ❌ No |

| Covers collisions with objects or vehicles? | ❌ No | ✅ Yes |

| Required by lenders? | ✅ Often | ✅ Often |

While both coverages protect your vehicle, they apply to different situations. Having both ensures that you're fully covered against various risks.

Do You Need Comprehensive and Collision Coverage?

Deciding whether to carry comprehensive and collision coverage depends on several factors:

- Vehicle value – If your car is new or expensive, these coverages provide vital protection.

- Loan/lease requirements – Lenders usually require both coverages until the loan is paid off.

- Risk factors – If you live in an area prone to theft, extreme weather, or high accident rates, maintaining both coverages may be wise.

- Cost vs. benefit – If your car is older and its value is low, paying for these coverages might not be cost-effective.

A good rule of thumb is to check your car’s actual cash value (ACV) and compare it to your deductible plus the annual premium for these coverages. If they exceed your car’s value, it may be time to drop them.

Conclusion

Comprehensive and collision coverage play essential roles in protecting your car from various damages. While comprehensive coverage safeguards against theft, vandalism, and natural disasters, collision coverage focuses on accident-related damages. Understanding these coverages can help you make informed decisions about your auto insurance policy and ensure you're adequately protected. Evaluate your needs carefully to determine whether carrying both types of coverage makes sense for your situation.