Liability vs. Full Coverage: Which Car Insurance Do You Need?

Liability vs. Full Coverage: Which Car Insurance Do You Need?

Car insurance is essential for protecting yourself and others on the road, but choosing the right policy can be overwhelming. One of the biggest decisions drivers face is whether to opt for liability insurance or full coverage. Understanding the differences between these policies can help you make an informed decision that suits your needs and budget.

What Is Liability Insurance?

Liability insurance is the minimum coverage required in most states. It covers damages and injuries you cause to others in an accident but does not cover damage to your own vehicle. This type of insurance typically includes:

- Bodily Injury Liability (BIL): Covers medical expenses, lost wages, and legal fees for the other party if you're at fault.

- Property Damage Liability (PDL): Pays for repairs to the other person's vehicle or property.

Liability insurance is generally more affordable, making it a good option for those driving older vehicles with lower market value.

What Is Full Coverage Insurance?

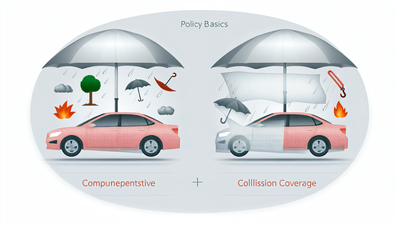

Full coverage insurance includes liability protection but also provides additional coverage for your own vehicle. It typically consists of:

- Collision Coverage: Pays for repairs to your car after an accident, regardless of fault.

- Comprehensive Coverage: Covers damages caused by non-collision events such as theft, vandalism, fire, or natural disasters.

While full coverage costs more than liability insurance, it offers greater financial protection, especially if you have a newer or financed vehicle.

Liability vs. Full Coverage: Key Differences

| Feature | Liability Insurance | Full Coverage |

|---|---|---|

| Covers damages to your car | ❌ No | ✅ Yes |

| Covers damages to others | ✅ Yes | ✅ Yes |

| Includes collision coverage | ❌ No | ✅ Yes |

| Includes comprehensive coverage | ❌ No | ✅ Yes |

| Typically cheaper | ✅ Yes | ❌ No |

Which Insurance Should You Choose?

The choice between liability and full coverage depends on several factors:

- Vehicle Value: If your car is older and has a low resale value, liability insurance may be sufficient. However, if your car is new, financed, or expensive to repair, full coverage is a safer bet.

- Budget: Liability insurance is more affordable, so it's ideal for those looking to minimize monthly expenses.

- Risk Tolerance: If you want peace of mind knowing your car is covered in various situations, full coverage is the better option.

- State Requirements: Some states require additional coverage beyond liability, so check your local laws before deciding.

Conclusion

When choosing between liability and full coverage insurance, consider your individual circumstances, vehicle value, and financial situation. Liability insurance is a cost-effective option for older cars, while full coverage provides comprehensive protection for newer or financed vehicles. Assess your needs carefully to ensure you have the right coverage for your driving habits and budget.

Still unsure? Speak with an insurance expert to compare policies and find the best fit for your situation.