Common Car Insurance Policy Terms Explained for New Jersey Drivers

Common Car Insurance Policy Terms Explained for New Jersey Drivers

If you're a New Jersey driver shopping for car insurance, the world of policies, premiums, and deductibles can seem overwhelming. Understanding insurance terminology is crucial for making informed decisions and ensuring you have the right protection on the road. In this guide, we'll break down common car insurance basics to help New Jersey drivers feel confident when choosing a policy.

Why Understanding Insurance Terminology Matters

Auto insurance isn't just a legal requirement in New Jersey—it's your financial safety net. Knowing the terms used in your policy can:

- Help you avoid costly mistakes

- Ensure you meet state requirements

- Empower you to choose coverage that truly protects you

Let's dive into the definitions every driver should know.

Key Car Insurance Terms for New Jersey Drivers

1. Premium

Your premium is the amount you pay to your insurance company for coverage. It can be billed monthly, semi-annually, or annually. Factors like your driving record, age, vehicle type, and even your zip code in New Jersey can influence your premium.

2. Deductible

The deductible is what you agree to pay out-of-pocket before your insurance kicks in after a claim. For example, if you have a $500 deductible and $2,000 in damages, you'll pay $500, and your insurer covers the remaining $1,500.

3. Liability Coverage

In New Jersey, drivers must carry minimum liability insurance. This covers bodily injury and property damage you cause to others in an accident. Remember: liability coverage doesn’t pay for your own injuries or damages.

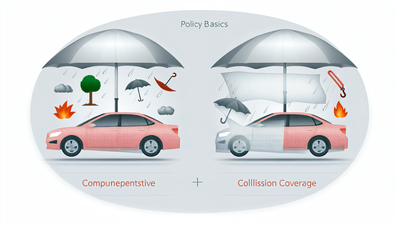

4. Comprehensive Coverage

This optional coverage handles damages not caused by collisions, such as theft, vandalism, fire, or natural disasters. If a tree falls on your car during a Jersey Shore storm, comprehensive coverage can save the day.

5. Collision Coverage

Collision coverage pays for damage to your vehicle resulting from an accident, no matter who's at fault. If you hydroplane on a rainy Garden State Parkway day and hit a guardrail, collision coverage helps repair your car.

6. Personal Injury Protection (PIP)

Also known as "no-fault insurance," PIP covers medical expenses for you and your passengers, regardless of who caused the accident. New Jersey requires drivers to have PIP, and it's crucial for covering hospital bills, lost wages, and even essential services.

7. Uninsured/Underinsured Motorist Coverage

Unfortunately, not everyone on the road has enough insurance. This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage.

Special Considerations for New Jersey Drivers

New Jersey offers two types of auto insurance policies: "Standard" and "Basic." The Standard policy provides more extensive coverage options, while the Basic policy is a cheaper alternative with minimal protection. Understanding the difference can significantly impact your financial security after an accident.

Additionally, New Jersey drivers must navigate the "verbal threshold" option—also called the "limitation on lawsuit" option—which affects your ability to sue for non-economic damages like pain and suffering after an accident.

Conclusion

Mastering car insurance basics doesn't have to be intimidating. By familiarizing yourself with these key insurance terms, New Jersey drivers can make smarter choices, ensure compliance with state laws, and drive with greater peace of mind. Remember, knowledge is the best co-pilot on the road to protection!

Ready to shop for a policy? Use this guide as a reference to ask the right questions and find the coverage that's perfect for your needs.