Car Insurance 101: Essential Policy Basics You Need to Know

Car Insurance 101: Essential Policy Basics You Need to Know

Car insurance is a crucial aspect of vehicle ownership, offering financial protection in case of accidents, theft, or damage. Whether you're a first-time car owner or looking to refresh your understanding, knowing the basics of car insurance helps you make informed decisions. This guide covers the essential aspects of car insurance policies, ensuring you're well-equipped to choose the right coverage for your needs.

Why Car Insurance Matters

Car insurance isn't just a legal requirement in most places—it's also a financial shield against unexpected expenses. Without adequate coverage, you may be left covering repair costs, medical bills, or even legal fees out of pocket. Understanding different policy options ensures you are protected from potentially devastating financial setbacks.

Key Components of a Car Insurance Policy

Car insurance consists of several components, each serving a specific purpose. Here are the main types of coverage:

1. Liability Coverage

This is the most basic type of car insurance and is usually required by law. It covers the costs of injuries or damages you cause to others in an accident. Liability coverage typically includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for injured parties.

- Property Damage Liability: Pays for damage caused to another person’s vehicle or property.

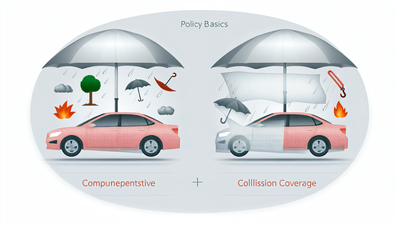

2. Collision Coverage

Collision coverage helps pay for repairs to your own vehicle if you're involved in an accident, regardless of who is at fault. This is especially useful for newer cars where repair costs can be high.

3. Comprehensive Coverage

This policy covers damage to your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters. If your car gets stolen or damaged due to hail, comprehensive coverage steps in.

4. Personal Injury Protection (PIP) or Medical Payments Coverage

PIP (or MedPay, depending on the state) covers medical expenses for you and your passengers, regardless of who caused the accident. PIP may also cover lost wages and other related costs.

5. Uninsured/Underinsured Motorist Coverage

Not everyone follows the law when it comes to carrying insurance. This coverage protects you if you're involved in an accident caused by a driver who has little or no insurance. It can help pay for medical bills and vehicle repairs.

Factors That Affect Your Insurance Premium

Several factors influence the cost of your car insurance policy, including:

- Driving Record: Accidents and traffic violations can raise your premium.

- Vehicle Type: Luxury or high-performance cars often cost more to insure.

- Location: Urban areas typically have higher premiums due to increased accident risk.

- Credit Score: In some states, insurers use credit scores to determine rates.

- Coverage Limits & Deductibles: Higher coverage limits increase premiums, while higher deductibles lower them.

How to Choose the Right Car Insurance Policy

When selecting a car insurance policy, consider the following steps:

- Assess Your Needs: Determine how much coverage you require based on your vehicle’s value and personal risk tolerance.

- Compare Quotes: Get multiple quotes from different insurers to find competitive pricing.

- Check Discounts: Many insurers offer discounts for safe driving, bundling policies, or installing anti-theft devices.

- Read the Fine Print: Understand the terms and conditions, including exclusions and claim procedures.

Conclusion

Car insurance is more than just a legal requirement—it’s a vital tool that protects you financially in case of accidents or unexpected events. By understanding the key components of a policy, factors affecting premiums, and how to choose the right coverage, you can ensure you have the protection you need. Take the time to explore your options and secure a policy that offers both peace of mind and financial security.